Hard Money Georgia Fundamentals Explained

Wiki Article

Getting The Hard Money Georgia To Work

Table of ContentsFascination About Hard Money GeorgiaSome Known Details About Hard Money Georgia Not known Details About Hard Money Georgia Some Of Hard Money GeorgiaWhat Does Hard Money Georgia Do?

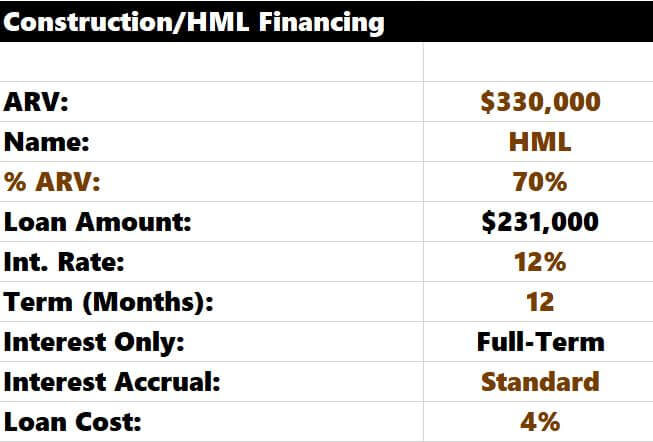

, are temporary lending tools that genuine estate investors can make use of to fund an investment job.There are two primary disadvantages to consider: Tough cash financings are convenient, but financiers pay a cost for obtaining this way. The price can be up to 10 portion factors higher than for a traditional finance.

As a result, these car loans feature much shorter settlement terms than conventional mortgage fundings. When picking a difficult money loan provider, it's important to have a clear idea of exactly how quickly the property will come to be lucrative to guarantee that you'll be able to pay off the lending in a prompt manner.

Not known Facts About Hard Money Georgia

Once more, loan providers might enable capitalists a bit of flexibility below.Tough money fundings are an excellent fit for affluent capitalists that require to get funding for a financial investment property swiftly, with no of the red tape that supports bank financing. When assessing difficult cash lending institutions, pay very close attention to the fees, rates of interest, and also lending terms. If you wind up paying way too much for a hard cash lending or cut the payment duration also brief, that can affect how successful your realty endeavor is in the long term.

If you're aiming to get a home to turn or as a rental residential or commercial property, it can be testing to obtain a standard mortgage. If your credit rating isn't where a traditional lender would like it or you need money quicker than a lender has the ability to supply it, you could be out of luck.

Not known Factual Statements About Hard Money Georgia

Tough cash lendings are temporary safe car loans that utilize the residential property you're acquiring as security. You will not locate one from your bank: Tough money car loans are supplied by alternative lenders such as specific capitalists and personal firms, who normally neglect sub-par credit report as well as various other monetary aspects and also instead base their choice on the residential property to be collateralized (hard money georgia).

Difficult cash fundings give several advantages for debtors. These consist of: From start to complete, a tough cash car loan could take simply a few days.

It's key to think about all the perils they subject. While hard cash lendings included benefits, a customer should likewise think about the threats. Amongst them are: Hard cash loan providers normally bill a higher rates of interest since they're assuming more danger than a traditional loan provider would certainly. Once more, that's because of the risk that a difficult money lender is taking.

The Only Guide for Hard Money Georgia

You're not sure whether you can afford to repay the tough cash finance in a brief period of time. You've obtained a strong credit rating and should have the ability to certify for a typical financing that likely brings a reduced interest rate. Alternatives to difficult money car loans consist of conventional home mortgages, house equity car loans, friends-and-family lendings or financing from the property's vendor.

The smart Trick of Hard Money Georgia That Nobody is Talking About

It is very important to take into consideration variables such as the lender's track record and interest prices. You could ask a relied on realty representative or a fellow residence fin for suggestions. Once you have actually toenailed down the right tough money loan provider, be prepared to: Generate the down settlement, which generally is heftier than the down settlement for a traditional home loan Collect the necessary documentation, such as evidence of income Potentially employ a lawyer to discuss the regards to the financing after you've been accepted Map out a strategy for settling the funding Equally as with any kind of loan, assess the advantages and disadvantages of a difficult money financing before you next page devote to borrowing.No matter what kind of funding you choose, it's probably a good suggestion to examine your free credit report and cost-free credit history record with Experian to see where your funds stand.

When you hear words "hard money car loan" (or "personal money car loan") what's the first thing that experiences your mind? Shady-looking lending institutions important source who conduct their company in dark streets as well as cost overpriced rate of interest prices? In prior years, some bad apples tarnished the tough cash offering market when a few predacious loan providers were trying to "loan-to-own", giving really dangerous fundings to consumers utilizing real estate as collateral and also intending to foreclose on the properties.

Report this wiki page